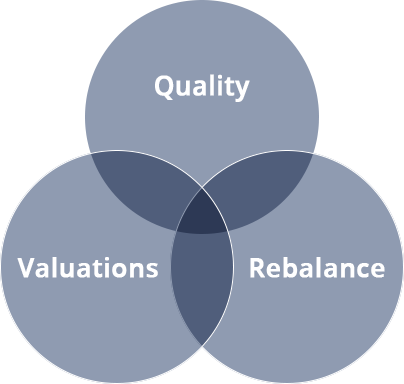

A sector-agnostic global equity fund that seeks to achieve long term capital appreciation by investing in quality companies through a systematic portfolio management process. Launched officially in December 2021, Paragon SAGE applies a fundamental bottom-up basis to build a portfolio of strong companies with a durable competitive advantage. To supplement the portfolio approach, the fund makes tactical adjustments to the cash levels in accordance with changes in market conditions.

As a result of demand from our largest institutional investors, Paragon SAGE also has an institutional tranche available to provide the best possible value.

| YEAR | JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | YTD | SINCE INCEPTION |

| 2021 | - | - | - | - | - | - | - | - | - | - | - | 0.30 | 0.30 | - |

| 2022 | -0.80 | -1.51 | 0.61 | -6.59 | 0.11 | -3.80 | 4.06 | -2.60 | -7.34 | 0.12 | 11.39 | -1.40 | -8.67 | - |

| 2023 | 8.19 | -3.43 | 3.87 | 0.70 | -0.60 | 2.21 | 3.15 | -3.72 | -2.67 | -2.24 | 4.79 | 3.87 | 14.19 | - |

| 2024 | -1.05 | 1.93 | 3.13 | -1.38 | 2.80 | -1.54 | 3.59 | 4.98 | 7.28 | -4.66 | 1.16 | 0.25 | 17.11 | - |

| 2025 | 2.86 | 0.48 | 3.34 | 26.60 |

"*" indicates required fields

Confirmation of Accredited Investor Status and Consent to the Terms of Use and Privacy & Cookies Policy

I confirm that I am an “Accredited Investor”, “Institutional Investor” or “Expert Investor” as defined under the Securities and Futures Act (Chapter 289) and Securities and Futures (Classes of Investors) Regulations 2018 of Singapore and qualify as such under one of the categories.

I have reviewed and hereby agree to the Terms of Use and Privacy & Cookies Policy for accessing this Website.